As society stands on the precipice of the quantum revolution, the question of how much a quantum computer, such as those developed by tech behemoths like Google, costs looms large. It is not merely a matter of dollars and cents; it unravels a tapestry of value, capability, and the nascent potential of quantum technology. But why does the price matter? Could the cost of these groundbreaking machines challenge our understanding of computing entirely?

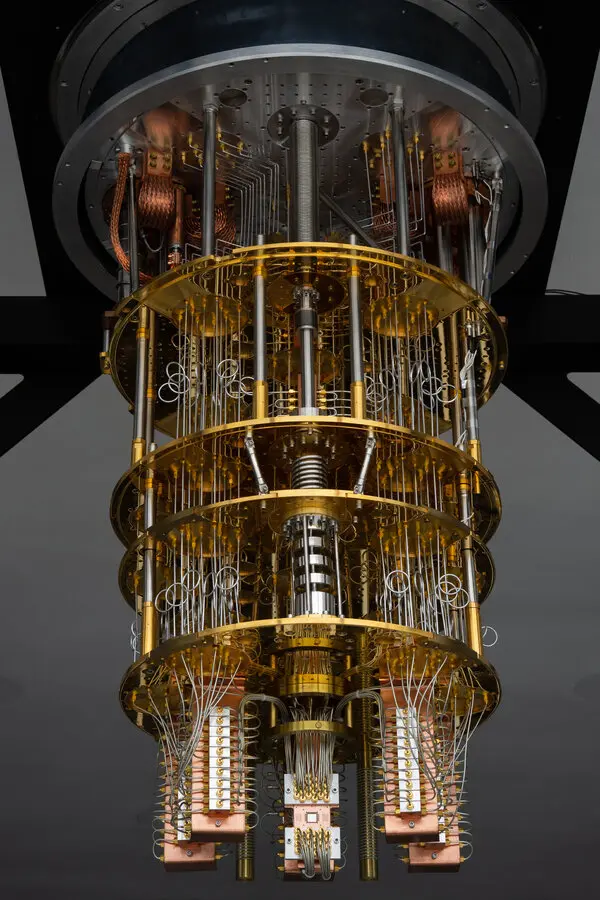

To embark upon an exploration of the costs associated with quantum computing, one must first understand the intricate nature of the technology itself. Quantum computers utilize quantum bits, or qubits, which can exist in multiple states simultaneously, a phenomenon known as superposition. This capability enables quantum computers to process vast amounts of information exponentially faster than traditional binary computers. However, this sophistication comes at a cost—both financially and in terms of the technological infrastructure required to maintain such systems.

The initial financial outlay for developing a quantum computer is immense. Researchers estimate that building a pragmatic quantum computer could cost anywhere from several million to several billion dollars. This financial burden arises from various factors, including the need for advanced materials, cutting-edge cryogenic technology, and specialized laboratory environments to preserve qubit coherence. For instance, Google’s Quantum AI division has invested heavily in building its quantum processors, employing superconducting qubits that require ultra-low temperatures to operate effectively, necessitating sophisticated cooling systems.

Moreover, the price tags associated with quantum computers are not purely academic; they reflect the competitive race among technological leaders. Companies like IBM, Microsoft, and Rigetti Computing are also vying for market supremacy in this emergent field, driving prices both up and down as research progresses. The implications of ownership and access to quantum machinery further complicate the financial landscape. The question arises: should access to such technology be democratized, or is it a privilege reserved for those with the deepest pockets?

Investment in quantum computing is not limited to the machines themselves. A considerable component of the financial equation involves talent acquisition and development. The complexity of quantum theory and its application in computing necessitates a workforce of brilliant physicists, engineers, and computer scientists who can innovate and elucidate quantum algorithms. The quest to hire and train such specialists is both competitive and costly. Thus, an organization’s overall investment in quantum computing encompasses not just hardware but also human capital.

In addition to the initial investment required, the operational costs associated with running a quantum computer can be daunting. Maintenance of cryogenic environments—often maintained at temperatures near absolute zero—demands continuous energy resources and expertise in specialized cryogenic engineering. The intricacies of quantum error correction pose another financial challenge. Unlike classical computers that can recover from errors with relative ease, quantum systems require intricate error-correction codes to manage qubits’ erratic behavior, amplifying expenses and strategic operational planning.

Nonetheless, amidst these challenges lies significant potential for cost-benefit analysis. The long-term benefits of quantum computing may outweigh initial expenditures in sectors such as drug discovery, materials science, optimization problems, and cryptography. Imagine a biopharmaceutical company drastically reducing timeframes to discover new medications or vaccine formulations due to the unparalleled processing capabilities of quantum machines. In these scenarios, the cost of quantum computers could be viewed not only as a monetary expenditure but also as an investment in transformative societal advancements.

The economic factors entwined with quantum computing extend further into the realm of public interest and policy. Governments across the globe are recognizing the strategic importance of quantum technology and investing in research initiatives to bolster their national capabilities. Programs to incentivize collaborative research among academia and industry could reshape the financial landscape, making quantum computing more accessible and fostering a broader array of innovations. But how can we ensure that these advancements serve the greater good rather than just the elite few?

The analogy of “race to the moon” is pertinent here as it underscores the need for sustained governmental and institutional support. Just as Apollo missions galvanized scientific interest and funding in the 1960s, present-day quantum endeavors necessitate similar vigor to secure vast investments that match the ambition of the visionaries in the field. Quantum computing commands not just a financial discussion but one of ethics, accessibility, and societal impact.

In conclusion, determining how much Google’s quantum computer costs entails delving deeper than mere numbers. It invites contemplation on the broader implications of quantum technology—the economic, ethical, and societal ramifications that accompany its development. As quantum computing spurs new challenges and evokes adventurous questions about the nature of computation, the pursuit of understanding its value becomes essential. With continued investment and inquiry, we may be on the cusp of an era where the cost of quantum computation could pale in comparison to the transformative potential it offers.