The intricate interplay between physical phenomena and economic systems has long captivated scholars across disciplines. In the realm of economics, we often hear the term “bubbles,” referring to asset prices that soar to unsustainable heights before an inevitable collapse. Yet, what if we introduce the concept of “anti-bubbles” to this discourse? How might such a construct challenge our understanding of market behavior and fragility, particularly in the context of economic theories that parallel principles from physics?

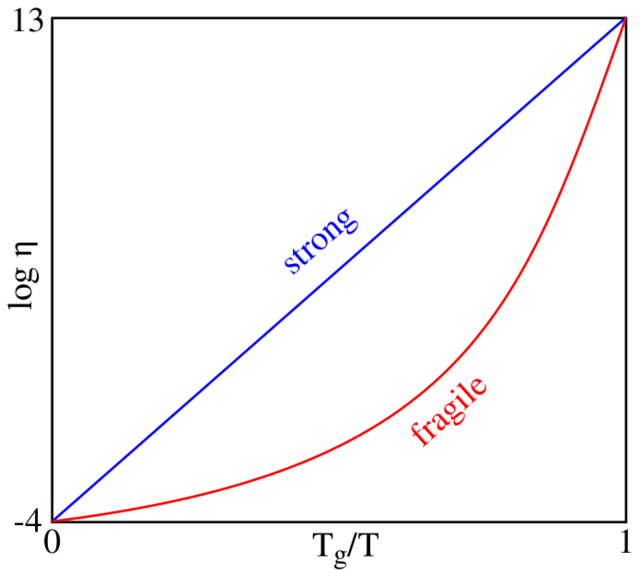

To comprehend anti-bubbles, we must first dissect the anatomy of traditional bubbles. Bubbles typically form in environments characterized by exuberant speculation, where investor psychology overrides fundamental valuations. This irrationality is akin to the molecular excitement observed in materials approaching a phase transition. Just as a solid material can transform into a less stable liquid form when subjected to heat, a market can evolve from a stable equilibrium into a volatile state due to psychological pressures. An exploration of anti-bubbles, conversely, necessitates a re-evaluation of these notions of stability and fragility.

Anti-bubbles can be conceptualized as inversions of conventional bubbles, where the market systematically underestimates an asset’s intrinsic value—essentially a mispricing of capital that results in a protracted downturn. This phenomenon would manifest in a market that exhibits dwindling confidence, characterized by disinvestment and uncertainty rather than exuberance. The pivotal question then arises: Can the modeling of anti-bubbles, guided by the nuanced principles of fragility and volatility derived from the laws of physics, propel us toward a more sophisticated comprehension of economic resilience?

To substantiate this inquiry, we delve into the theory of fragility—first articulated in the context of materials science, where certain substances display variable responses to stress. In economic terms, fragility can retain a semblance of objectivity, particularly when discussing market structures. Much like brittle materials that shatter under pressure, economic systems fraught with uncertainty may crumble under the weight of exogenous shocks. In contrast, economies with greater elasticity could be likened to ductile materials that deform rather than disintegrate when subjected to stress.

In exploring these analogous frameworks, it becomes imperative to scrutinize how anti-bubbles produce their own distinct forms of fragility. Essentially, when investors grown disenchanted and miscalculate the fundamental worth of an asset, the prevailing sentiment can create a self-reinforcing loop of pessimism. This cycle intensifies vulnerability as capital flees and investment dries up, leading to further declines and possibly triggering cascading effects across interconnected markets. Just as a fragile glass structure might shatter into a myriad of pieces, economies experiencing anti-bubbles may face systemic collapse.

The implications of understanding anti-bubbles extend beyond mere theoretical musings. If one were to couple economic analysis with insights from the physics of fragility, policymakers might be equipped to anticipate downturns with greater acuity. For instance, if a particular asset class exhibits characteristics that align with anti-bubble behavior—such as prolonged undervaluation despite solid fundamentals—strategies to bolster investor confidence might be enacted preemptively. In this light, employing analytical methodologies from physics could yield novel predictions regarding human behavior in market contexts, thus enriching the field of behavioral economics.

Moreover, the discussion regarding anti-bubbles invites us to consider the microfoundations that underpin market psychology. The divergence from rational expectations nears a state of entropy, wherein the system’s predictability falters. Compounding this complexity is the unpredictable nature of sentiment, which, under stress, can amplify perceptions of fragility—much like how certain materials appear more susceptible to catastrophic failure as they approach their yield point.

However, the challenge remains: How do we quantitatively measure anti-bubbles or distinguish them from typical market corrections? The difficulty lies in developing robust metrics that reflect the intricate dynamic balancing of investor sentiment and market valuation. A potential methodology might involve analyzing the divergence between prevailing asset prices and an array of fundamental indicators over time. By correlating these two variables, we may unearth patterns indicative of an impending anti-bubble.

Additionally, the philosophical implications of framing economic behaviors through the lens of physical fragility bring to light profound questions. What does it mean for an economy or market to be inherently fragile? How might we cultivate resilience against the inherent unpredictability of investor sentiment? Recognizing the forces of human psychology—exacerbated by external stimuli—could allow for a paradigm shift in economic theory, fostering a new model of stability that is intrinsically adaptive and anticipatory.

In conclusion, the exploration of anti-bubbles in economics not only posits a playful yet substantial question but also broadens the horizons of how we perceive market fragility. As we draw parallels between the physical world and economic systems, we unveil opportunities to develop innovative frameworks that embrace complexity while aspiring for resilience. The fusion of these disciplines holds the potential to reshape our understanding of economic theory, ultimately leading to more nuanced models that capture the unpredictable nature of human behavior in the marketplace. Thus, examining the symbiotic relationship between physics and economics could be the key to unlocking greater predictive power and fostering sustainable growth.