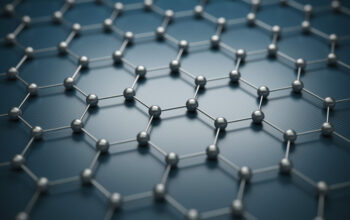

As the 21st century unfolds, the world increasingly turns to novel materials that promise to revolutionize a myriad of industries. Among these, graphene emerges as an exceptionally compelling candidate. A single layer of carbon atoms arranged in a two-dimensional honeycomb lattice, graphene is celebrated not only for its remarkable electrical, mechanical, and thermal properties but also for its versatility across various applications. This exploration delves into how one can proficiently invest in graphene, from understanding the material to the diverse avenues available for investment.

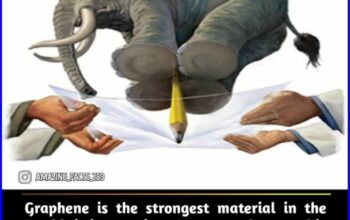

Graphene’s allure begins with its extraordinary characteristics. This material is lauded for being one of the strongest substances known, possessing a tensile strength of over 130 gigapascals, while remaining lightweight and highly conductive. Such properties have incited interest across sectors including electronics, energy storage, and composites, making graphene an attractive proposition for investors seeking opportunities in burgeoning technologies.

To embark on the path of investing in graphene, an understanding of its market dynamics is pivotal. The global graphene market has been expanding exponentially, projected to reach various billion-dollar valuations within the next decade. This magnanimous growth trajectory suggests an increasing demand for graphene-based products, spurred by advancements in science and technology. Observing the landscape through the lens of material science reveals catalysts driving investment such as governmental initiatives to promote nanotechnology, increasing corporate interest in renewable energy sources, and the integration of graphene into consumer products.

One viable pathway for investment is through publicly traded companies engaged in graphene research and production. A plethora of firms operates within this niche, from startups pioneering breakthroughs in graphene production processes to established corporations integrating graphene into their product offerings. Conducting due diligence is imperative; investors should analyze company fundamentals, including financial health, revenue growth, and the scalability of graphene-based applications. Noteworthy examples may include companies specializing in advanced materials or those partaking in collaborative ventures with research institutions to expedite graphene commercialization.

Another enticing approach is venture capital investment in startups focused on graphene innovation. This route, albeit higher risk, often presents substantial rewards for those judicious enough to identify promising enterprises at their nascent stages. The landscape of graphene-centric startups is varied; potential candidates might be involved in sectors such as pharmaceuticals, electronics, or even construction materials. Utilizing platforms that connect investors with burgeoning tech companies can facilitate access to information about newcomers in the graphene space along with their projected market impacts.

For individuals seeking to invest in graphene without diving into individual stocks, exchange-traded funds (ETFs) present an advantageous alternative. Several ETFs focus on companies dedicated to graphene or advanced materials, allowing for diversified exposure to the sector. The inherent advantage here lies in the risk mitigation afforded by diversification; the performance of an ETF is buffered by the collective performance of its constituent companies, which can soften volatility associated with investing in single stocks.

Moreover, another investment avenue lies in supporting research and development initiatives through crowdfunding platforms. Such platforms enable everyday investors to contribute toward groundbreaking research projects, offering an opportunity to be on the vanguard of technological innovation. While this approach is more suited to investors with a passion for scientific advancements, the potential for profound returns lingers should a project successfully transition from theory to market application. Engaging in this manner fosters a sense of community among investors and researchers alike, uniting them in a shared vision for the future.

There also exists a burgeoning field of academic partnerships and collaborations to consider. By aligning with academic institutions or research laboratories working on graphene projects, investors can position themselves strategically to capitalize on emerging discoveries and innovations. Universities are often at the forefront of technological advancements, and partnerships can yield the dual benefit of knowledge acquisition and potential financial support for cutting-edge research.

It is vital to remain cognizant of the ethical implications and regulatory frameworks surrounding graphene production and use. As with all investments, particularly those within niche markets, attention to environmental sustainability and compliance with local and international regulations is paramount. Investors ought to scrutinize potential environmental impacts, such as waste management from graphene production processes, and advocate for practices that uphold ecological integrity.

In conclusion, navigating the intricate domain of graphene investment necessitates a multifaceted approach. With its unparalleled properties and vast potential implications for industries, investors have an enticing opportunity to engage with this material in various forms—be it through equities, venture capital, ETFs, or academic collaborations. As the graphene market continues to expand, cultivating a robust understanding of its dynamics, alongside an awareness of ethical considerations, will empower investors to engage in this promising venture with foresight and analytical acuity. The fascination with graphene lies not only in its properties but also in its potential to redefine our technological landscape.