In the burgeoning nexus of finance and quantum mechanics, the concept of a “quantum finance job” emerges as a fascinating intersection, akin to a modern alchemist seeking to transmute the base elements of traditional financial paradigms into golden opportunities. The term itself may not be immediately recognizable, yet it encompasses a myriad of roles that harness the principles of quantum computing to revolutionize financial analysis, risk assessment, and investment strategies.

The term “quantum finance” can be deceptively simplistic, serving as an overarching umbrella that encompasses several specialized vocations. Some of the most prevalent positions in this captivating field include Quantum Financial Analyst, Quantitative Analyst (or Quant), and Quantum Algorithm Developer. Each role invites practitioners to delve into the depths of mathematical theory, machine learning, and financial forecasting, thus transforming abstract theoretical constructs into pragmatic investment decisions.

At the core of quantum finance lies the Quantum Financial Analyst, who is nothing short of a modern-day oracle. Such analysts employ quantum algorithms and statistical models to discern patterns from large datasets, sifting through noise to uncover signals that may indicate potential market movements. Like sculptors chiseling away at marble, they meticulously refine their analyses, applying nuances in economic indicators to forecast future trends with unprecedented accuracy. The role necessitates a robust understanding of quantum computing principles while simultaneously maintaining a grasp of traditional finance—a dichotomy that underscores the allure of this vocation.

Next on the spectrum of quantum finance is the Quantitative Analyst, colloquially known as a “Quant.” This professional embodies the analytical prowess akin to a chess grandmaster, anticipating market moves several steps ahead. Quants utilize mathematical models and computational tools to devise trading strategies and risk management techniques. Their acumen in statistics, calculus, and programming is not merely beneficial; it is essential. In a world where milliseconds can dictate financial success or failure, Quants employ their sophisticated skill sets to optimize trading algorithms, mirroring the symbiotic relationship between physicists and mathematicians in quest of universal truths.

The quantum finance ecosystem is also intertwined with the role of the Quantum Algorithm Developer. This position requires an orchestration of creativity and technical expertise, akin to a conductor leading a symphony of qubits and algorithms. Developers in this domain are tasked with creating and refining quantum algorithms that can process information in ways classical computers cannot. They meticulously craft algorithms designed to tackle complex financial problems—such as portfolio optimization and option pricing—with deference to quantum superposition and entanglement effects. Their work can lead to transformative insights, akin to the eureka moments of physicists unraveling the intricacies of the universe.

While the specific titles may vary, the underlying competencies tend to converge around several core themes: an intimate knowledge of both finance and quantum physics, proficiency in programming languages such as Python or C++, and an aptitude for data analytics. This unique amalgamation of skills can be seen as a modern iteration of the Renaissance ideal, wherein individuals are encouraged to transcend disciplinary boundaries, cultivating a broad intellectual curiosity and diverse skill set.

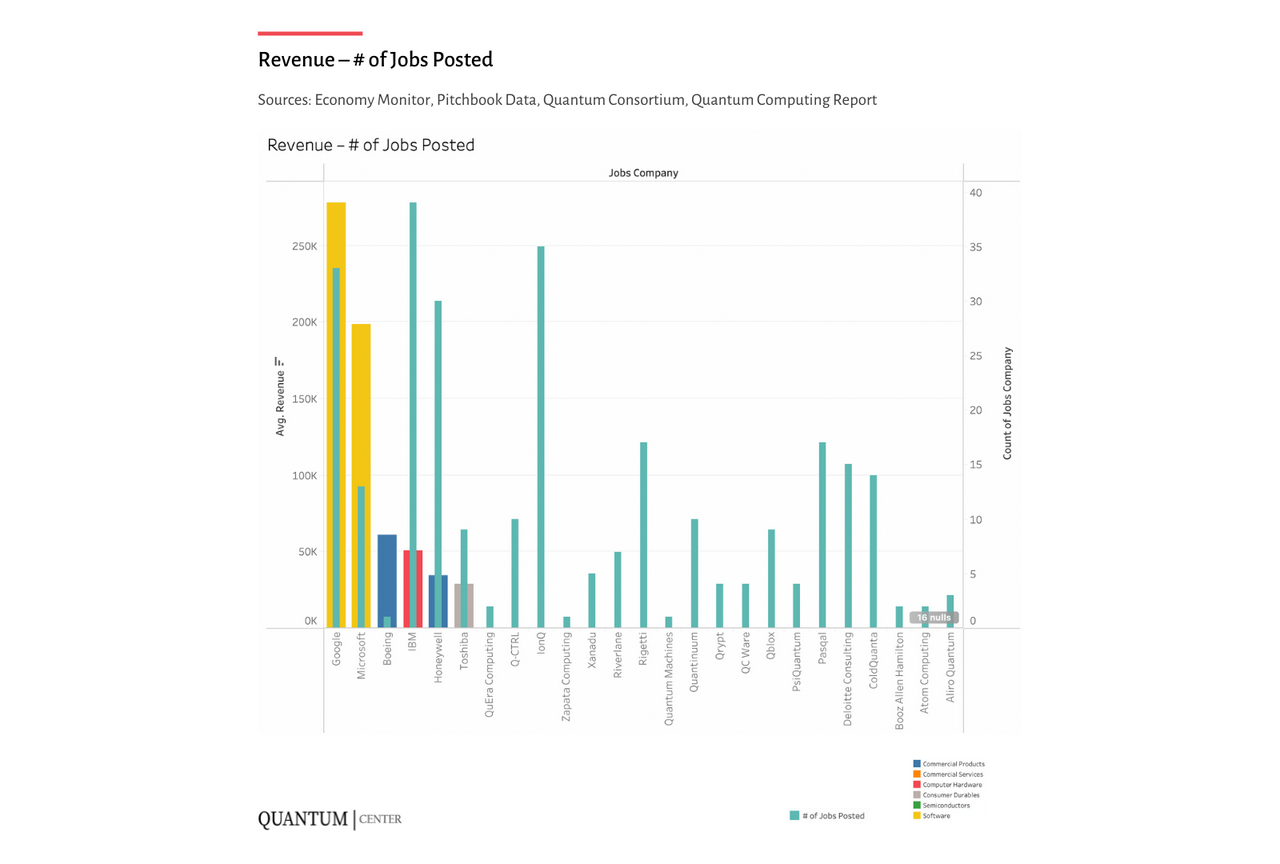

The rising demand for quantum finance professionals is largely fueled by advancements in technology and the growing complexity of financial markets. The integration of quantum computing into finance is comparable to the Industrial Revolution: it promises to alter industry landscapes across the globe. As companies grapple with enormous amounts of data, from transaction records to market sentiment analyses, the need for those who can deftly navigate this complexity becomes increasingly pertinent. Quantum finance jobs, therefore, represent more than just career paths; they signify the onset of a new era in financial management.

Moreover, as these roles proliferate, the educational landscape is adapting to meet the requirements of aspiring quantum finance professionals. Universities and institutions are beginning to offer specialized courses and programs that combine finance, mathematics, and quantum mechanics. Emerging talents will find themselves not only equipped with theoretical acumen, but also with practical skills that can shape the future of financial markets. This educational recalibration aligns with the notion of interdisciplinary collaboration—an intellectual symbiosis essential for tackling the challenges posed by the convergence of quantum mechanics and finance.

As we stand on the precipice of this new frontier, the prospects for those embarking on a career in quantum finance are nothing short of exhilarating. To visualize an ever-evolving landscape where knowledge harmonizes with novel technologies is akin to gazing into a crystal ball—one that reflects both the uncertainties of the future and the potential for groundbreaking discoveries. Quantum finance jobs invite trailblazers to explore uncharted territories, encouraging innovation akin to explorers mapping the vast oceans for the first time.

In summary, the job titles associated with quantum finance—ranging from Quantum Financial Analyst to Quantitative Analyst and Quantum Algorithm Developer—promote a paradigm shift in our understanding of financial systems. These roles are imbued with the potential to redefine risk assessment, enhance predictive accuracy, and innovate financial strategies, fostering a discipline where finance embraces the quantum realm. Thus, the unique allure of quantum finance positions resides not only in their intellectual rigor but also in their promise of shaping a dynamic economic landscape molded by the principles of quantum science.