Quantum computing represents a seminal shift in computational paradigms, promising to revolutionize various sectors, including finance, cryptography, material science, and artificial intelligence. As businesses and investors alike turn their attention to this burgeoning field, it is imperative to understand both the potential and the challenges inherent in quantum computing. This exploration delves into the various dimensions of quantum computing and its implications for tech stock investing.

The Fundamentals of Quantum Computing

At its core, quantum computing leverages the principles of quantum mechanics to perform calculations at unprecedented speeds. Unlike classical bits, which can exist in one of two states (0 or 1), quantum bits, or qubits, can exist simultaneously in multiple states due to superposition. This capability enables quantum computers to solve complex problems exponentially faster than classical systems. Moreover, entanglement, another cornerstone of quantum mechanics, allows qubits that are entangled to be interdependent such that the state of one qubit instantly influences another, even across significant distances.

The Promise of Quantum Computing

The promise of quantum computing lies not only in its speed but also in its ability to tackle problems that are currently insurmountable for classical computers. For instance, quantum algorithms could determine the optimal investment strategies in stock markets by analyzing colossal datasets with multiple variables affecting stock prices in real time. Additionally, in the pharmaceutical industry, quantum computing could significantly expedite drug discovery processes by simulating molecular interactions far beyond the capacity of conventional computational methods.

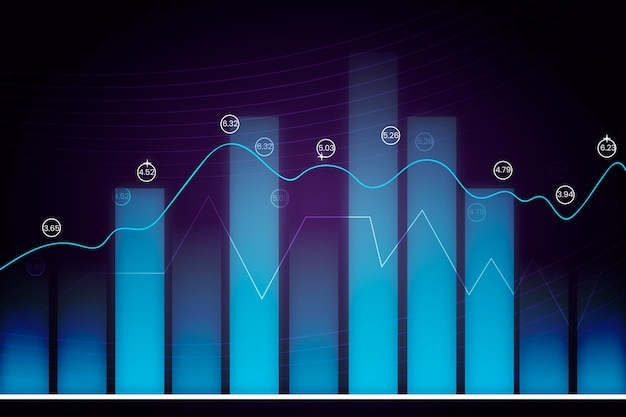

Optimal Applications in Finance

Within the financial sector, quantum computing offers a plethora of applications that could transform how investors analyze and interpret market dynamics. For example, quantum-enhanced algorithms can revolutionize portfolio optimization and risk assessment. Classical methods often struggle with the complexities of financial models, but quantum algorithms can efficiently process multi-dimensional data, yielding more accurate predictions.

Furthermore, quantum computing holds great promise for improving cryptographic security. As current encryption methods may become outdated, quantum-safe algorithms are in development, which could lead to more secure transactions and data integrity in financial operations. Investors need to stay attuned to the advancements in this area, as those companies that harness such technology could emerge as market leaders.

The Market Landscape

As an investor, it is vital to recognize the organizations spearheading quantum computing innovations. The market comprises several key players, including tech giants like Google, IBM, and Microsoft, alongside specialized companies such as Rigetti Computing and IonQ. These enterprises are not merely developing quantum hardware; they are also building entire ecosystems built around quantum computing platforms, fostering a new breed of application development that capitalizes on this technology.

Analyze the strategies these companies employ. Google has made headlines with its quantum supremacy claims, while IBM’s quantum cloud services are paving the way for broader access to quantum resources. Investing in stocks of companies with robust research and development pipelines in quantum technology may yield substantial returns as the technology matures.

Challenges and Limitations

Despite its potential, quantum computing is not without its challenges. Quantum decoherence, the process where quantum systems interact with their environment, poses significant hurdles to maintaining the operational integrity of qubits. Companies are actively researching error-correcting codes and advanced materials to mitigate these issues. Understanding the unique challenges faced by each player in this field is essential for making informed investment decisions.

Additionally, the current high costs associated with designing, building, and maintaining quantum computers may impede near-term widespread adoption. The nascent industry still grapples with scalability, requiring substantial investment and innovation before quantum computers can be deployed on a mass scale. Thus, investors should be cautious, assessing the financial stability and strategic vision of companies before committing resources.

Future Prospects and Investment Strategies

Looking ahead, investors must approach the quantum computing landscape with a balanced perspective. While the excitement surrounding quantum capabilities is justified, pragmatism is necessary. As with any emerging technology, volatility can pose risks. Consider diversifying investments across different tech stocks, including those involved in quantum research and those that may benefit indirectly, such as companies focusing on classical machine learning and AI integration.

Moreover, keeping abreast of legislative and regulatory developments in technology can provide insights that may influence market behavior. The global race toward quantum supremacy may trigger government investments and incentives that could significantly impact the industry landscape.

Conclusion

The promise of quantum computing is profound, with the potential to redefine technological capabilities across various sectors. For investors, understanding this dynamic landscape requires keen insight into technological advancements, market leaders, and potential hurdles. While caution is warranted given the uncertainties surrounding this field, well-informed investment strategies can position investors to capitalize on the inevitable breakthroughs that will drive the future of quantum computing. As the technology matures, those who stay informed and adapt their strategies in accordance with emerging trends may find themselves at the forefront of a transformative wave in tech stock investing.