The inquiry into the comparative value of graphene and gold elicits an immediate curiosity: which material commands a higher price per unit weight? At first glance, this question may seem rather straightforward, but a deeper exploration into the characteristics, applications, and economic implications of these two illustrious substances reveals a far more intricate narrative. In this discussion, we will embark on a journey through the realms of material science, economics, and innovation to illuminate the fascinating dynamics of graphene and gold.

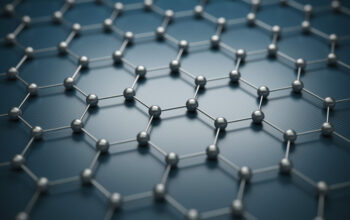

Graphene, a one-atom-thick derivative of carbon, has garnered acclaim for its unparalleled properties. This two-dimensional material is lauded for its extraordinary electrical conductivity, mechanical strength, and thermal resilience. Characterized by an atomic structure that consists of a honeycomb lattice, graphene exhibits superior qualities that enable it to surpass conventional materials. It is roughly 200 times stronger than steel while remaining exceptionally lightweight. Researchers and industrialist alike have posited that graphene possesses the transformative capacity to revolutionize several sectors, including electronics, energy storage, and composite materials.

Conversely, gold has retained its status as a coveted asset for millennia, revered not only for its aesthetic qualities but also for its historical significance in economics and trade. The intrinsic value of gold derives from its scarcity, malleability, and resistance to corrosion. Used predominantly in jewelry, electronics, and as a monetary standard, gold has entrenched itself deeply into societal structures and cultures. Its performance as a safe haven during economic volatility accentuates its continued allure as an investment asset. Yet, gold’s intrinsic properties are well-defined and predictable, which often do not adapt to the cutting-edge innovations that characterize the contemporary materials sector.

To assess the economic aspects of both substances, we must consider their production costs. The extraction and refinement of gold are laborious processes, involving extensive mining and intricate purification techniques, which all contribute to its high market valuation. As of early 2023, gold’s price hovered around $1,800 per ounce, reflecting its established valuation. However, it is noteworthy that gold’s price fluctuates due to market dynamics, including investor sentiment and socio-political factors, making it susceptible to volatility.

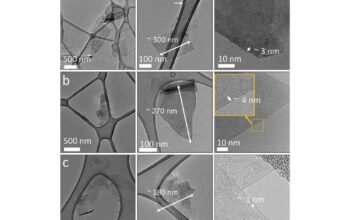

In stark contrast stands graphene, which does not yet have a universally established price point. The nascent stage of graphene production translates into considerable variability in cost. As of recent reports, the price of graphene can vary dramatically, influenced by its form—whether as graphene oxide, reduced graphene oxide, or pure graphene. While some estimates suggest that purveyors might charge up to $100 per gram for high-quality graphene, the price can drop significantly as production methodologies evolve. Innovations in mass production techniques such as chemical vapor deposition (CVD) and liquid-phase exfoliation promise to diminish the production costs and potentially democratize access to this invaluable material in the coming years.

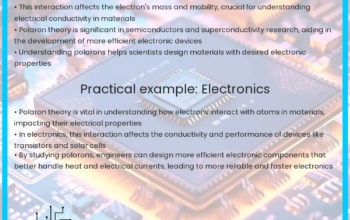

The allure of graphene extends beyond its production costs. Its prospective applications offer the tantalizing prospect of reshaping entire industries. In electronics, graphene is lauded for its capability to create faster and more efficient transistors, while in energy storage, it holds the potential to construct batteries with significantly improved charge capacities. The aerospace sector is another beneficiary, where graphene composites may spawn lighter, stronger materials conducive to enhanced fuel efficiency. Thus, the implications of a widespread adoption of graphene could lead to a shift in economic paradigms, augmenting its value from a mere material to a cornerstone of technological advancement.

However, as we ponder the broader implications, the question emerges: can graphene truly outperform gold in terms of value, or do the established economic principles surrounding gold provide it with a sustained edge? The perceived value of a material is bolstered not only by its utility but also by its cultural and historical contexts. While graphene heralds a novel era of materials science, it is bound by the challenges of public perception and the necessity of widespread acceptance.

Further complicating this analysis is the fact that the economic landscapes of both materials are impacted by environmental considerations. The extraction of gold is often marred by environmental degradation and ethical concerns, which have prompted a movement towards sustainable practices in the mining sector. Conversely, the production methodologies for graphene are not devoid of ecological implications. The pursuit of environmentally friendly synthesis methods remains a pivotal aspect of graphene’s future and its acceptance within various markets.

In examining the ultimate question—what is more expensive: graphene or gold?—we arrive at a conundrum defined by fluctuating economic realities, emerging technologies, and evolving societal values. Gold serves as a time-honored asset, enshrined in economic systems across the globe, whereas graphene represents a frontier material poised to disrupt traditional paradigms. It will be the interplay between innovation, sustainability, market demand, and societal perception that will dictate the eventual valuation of these materials. Thus, the reader is presented not merely with a comparative analysis but with the seeds of a contemplative challenge: what is the true cost of progress, and at what price do we value the materials that will define our future?